Experience the ease of on-demand pay & financial education benefits

Tapcheck is an award-winning employee benefit that allows employers to offer on-demand pay and complimentary financial education. Available at no cost to employers, Tapcheck uses an intuitive mobile app to give workers greater control over their finances, which reduces their stress and improves business performance and profitability.

Integration benefits

Increase business performance & productivity

With less financial stress due to on-demand pay, average employee productivity increases by 49% and 79% of surveyed employees would be willing to switch to employers who provide on-demand pay.

Hands-off administration with customer service

Tapcheck integrates into existing software systems (payroll, time & attendance, POS) and is hands-off post-integration. Tapcheck takes care of employer and employee support through in-app, email, and phone options.

Valuable tool to attract & retain employees

Employers offering the benefit of earned wage access see an average 2x increase in applicants and 50% reduction in employee turnover. Tapcheck provides employee recruitment and onboarding tools.

Integration Features

Tapcheck’s implementation and customer success team will walk your staff through the easy API setup that will allow the Tapcheck platform to access your employees completed/approved hours since last payroll.

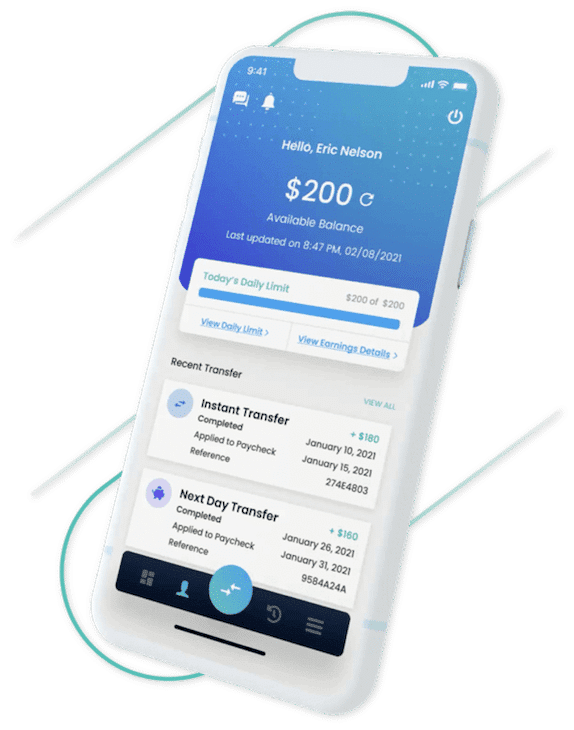

Intuitive mobile app for on-demand pay

Tapcheck is available 24/7 as employees have the need to access their earned wages ahead of the next scheduled payday. Using the intuitive Tapcheck app, employees choose from instant and next-day transfer options and can choose the destination for their funds.

Tapchek’s optional paycard is feature-rich and great for non-banked employees and as a replacement for live checks. It is free to use for payroll disbursements and offers benefits like direct deposit, bill pay, & free in-network ATM withdrawals.

What information is shared?

Through Tapcheck’s integration with AlayaCare, completed caregiver shifts and hours are shared and used in conjunction with payroll data to calculate accrued net earnings since last payroll. The lesser of this amount and a care giver’s daily withdrawal limit determines how much can be withdrawn each day.

No-cost, no-risk for employers

Tapcheck costs nothing to implement or on an on-going basis for employers. Tapcheck fronts the funds withdrawn by employees, requiring no escrow accounts and avoiding any impact to current employer cash flow. Because of Tapcheck’s seamless integrations with 40+ payroll and 30+ time platforms, the service requires no additional burden or administration effort from your staff after initial configuration.

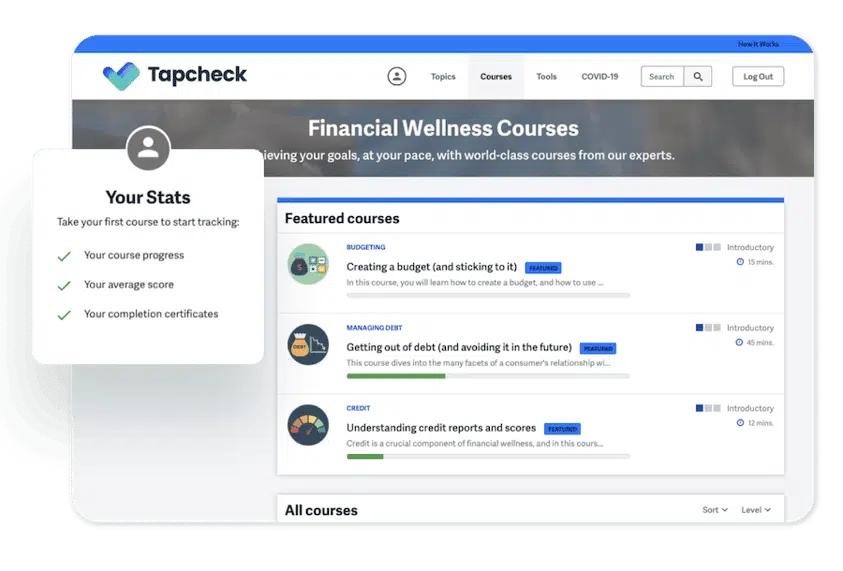

Complimentary financial education

Free financial education courses, calculators, and related content help build employee financial wellness, increasing savings by up to 55% in a 12-month period in addition to improving other financial wellness metrics related to goal planning, credit management, and emergency planning.

Pricing

Please contact Tapcheck for pricing options

Get Started

If you’re interested in learning more about our partner integration with Tapcheck, fill out the form today and we’ll be in touch.